Factoring is a smart solution to your cash flow problem. Factoring company will advance you cash against your unpaid invoices while waiting for the payment from your customer. As such, you’ll be able to maintain a healthy cash flow and focus on expanding your business.

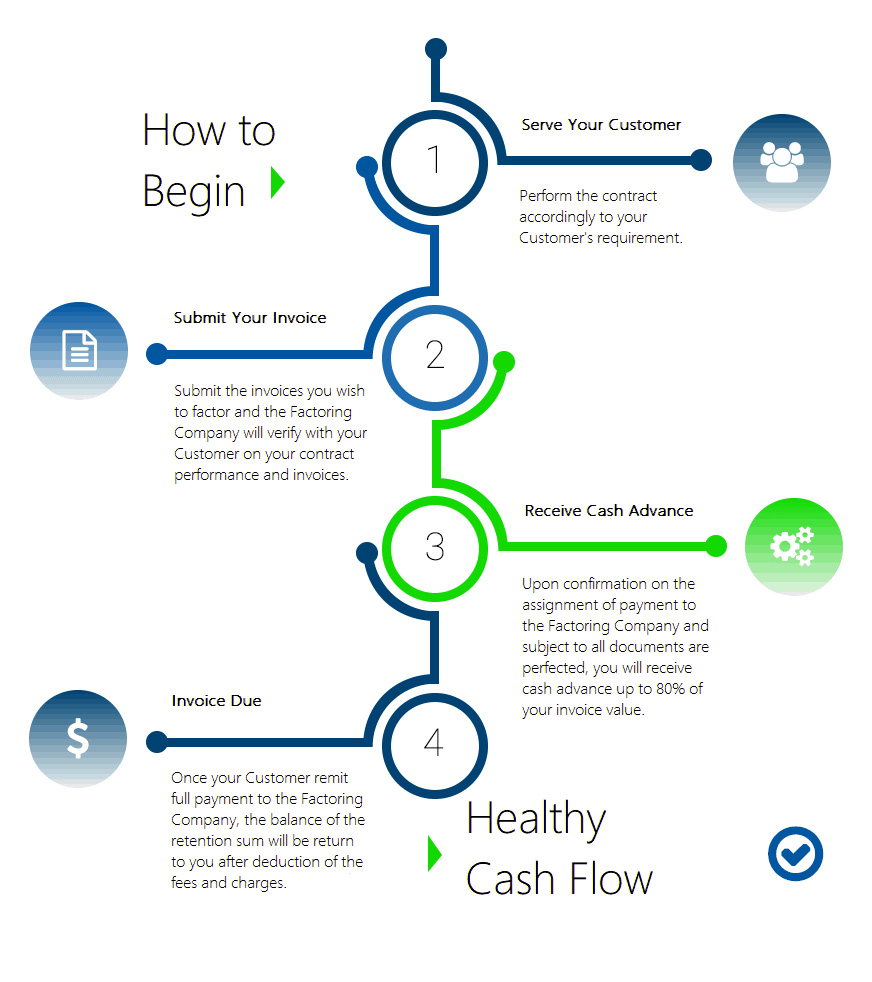

HOW DOES FACTORING WORK

WHAT ARE THE BENEFITS OF FACTORING

- It is hassle-free and fastest solutions to your cash flow problem.

- With healthy cash flow, you can focus more on your business instead of the collection of your receivables.

- Fair and competitive charges for a short-term finance solution.

WHO CAN BENEFIT FROM FACTORING

Factoring is best suits the Small and Medium Enterprises especially the newly start-up businesses that do not have track record and credential to qualify them for bank facility. Anyhow, factoring suits all vendors and contractors that performing contracts for either the Public Listed Companies, Federal or State Government and its Agencies or Government Link Companies (GLCs) despite the size and track record of their company.